oregon tax payment system

Late filings are subject to civil penalties of 500 per day minimum and up to 10000 maximum ORS 731988 Civil penalties. You have been successfully logged out.

Gop Tax Bill Win A Big Loss For Berea College College Berea College Berea Open Source Code

To electronically pay state payroll taxes including the WBF assessment by electronic funds transfer EFT use the Oregon Department of Revenues self-service site Revenue Online.

. Mail a check or money order. These benefits are funded by State Unemployment Tax Act SUTA payroll taxes paid by employers as well as reimbursements from governmental and non-profit employers. The Oregon Tax Payment System uses the ACH debit method to make an Electronic Funds Transfer EFT to the state of Oregon for combined payroll taxes or corporation excise and income taxes.

The first thing to know about the state of Oregons tax system is that it includes no sales tax. You may now close this window. The final one-third payment is due by May 15.

Special Oregon Sch P. Any questions you have about the payment systems will need to be directed to them. The links below have been provided for your convenience.

The Oregon Small Business Development Center Network. EFT Questions and Answers. Submit your application by going to Revenue Online and clicking on Apply for ACH credit under Tools.

Payments can be made using the Department of Revenues site Revenue Online httpsrevenueonlinedororegongovtap_. Cookies are required to use this site. Be advised that this payment application has been recently updated.

The payment system is managed by Department of Revenue. Payment is coordinated through your financial institution and they may charge a fee for this service. This means that neither state nor local authorities collect taxes on the sale of products or services.

10 of unpaid tax liability. Click Here to Start Over. If you have any questions or problems with this system please call our EFT HelpMessage Line at 503-947-2017 or visit our EFT Questions and Answers.

Regular unemployment insurance UI benefits are paid to eligible people who are unemployed or have had their hours reduced through no fault of their own. PENALTIES AND INTEREST FOR LATE PAYMENTS. Oregon Tax Payment System Oregon Department of Revenue.

Skip to Main Content. Pay the Full Payment amount on or before November 15 and receive a 3 discount on the current years tax amount. SBAgovs Business Licenses and Permits Search Tool allows you to get a listing of federal state and local permits licenses and registrations youll need to run a business.

The Beaver State also has no sales taxes and below-average property taxes. Residents of the greater Portland metro area also have to pay a tax to help fund the TriMet transportation system. UI Payroll Taxes.

Oregon levies a progressive state income tax system with one of the highest top rates in the US at 990. Your browser appears to have cookies disabled. OPRS is a reporting system only.

You have successfully logged out of the Oregon Department of Revenue Tax Payment System. 10 of unpaid tax liability. Instead the state generates revenue with a statewide income tax of 475 to 99 ranking among the highest in the nation.

It is not a payment system. Electronic payment from your checking or savings account through the Oregon Tax Payment System. Pay the two thirds payment amount on or before November 15 and receive a 2 discount on the amount of current year tax paid.

You can make ACH debit payments through this system at any time with or.

Oregon S Crazy Income Tax Brackets Editorial Oregonlive Com

State Of Oregon Blue Book Government Finance Taxes

State Of Oregon Oregon Department Of Revenue Payments

How Strong Is The Economy Oregon Office Of Economic Analysis Business Risk Economy Economic Analysis

Oregon State 2022 Taxes Forbes Advisor

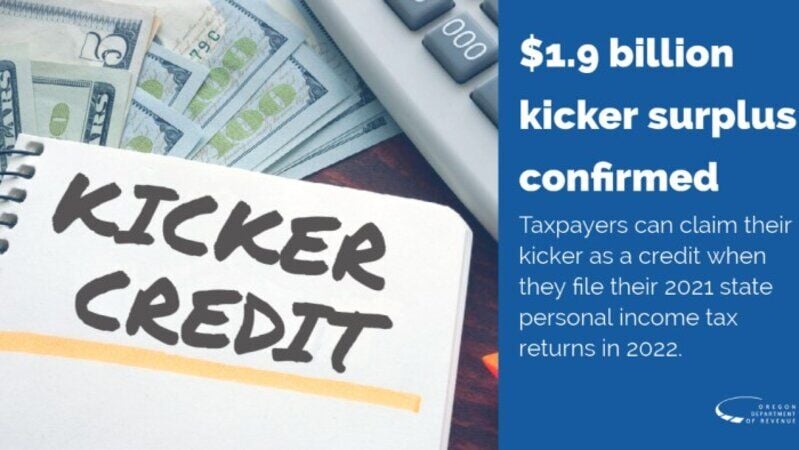

Oregon Taxpayers Will Receive Kicker Rebate On 2021 Tax Returns Thanks To 1 9 Billion Surplus Local Kdrv Com

Hometown News Madras Central Oregon Daily

![]()

Oregon Judicial Department Ojd Courts Epay Online Services State Of Oregon

Pass Through Income Tax Loophole Favors The Well Off While Disadvantaging Workers Oregon Center For Public Policy

Assessor Malheur County Oregon

Wage Inequality In Oregon A Wide Gap Article Display Content Qualityinfo Inequality Lorenz Curve Seasonal Jobs

Word Google Docs Pages Free Premium Templates Invoice Template Templates Letter Templates

Oregon Taxpayers Will Receive Kicker Rebate On 2021 Tax Returns Thanks To 1 9 Billion Surplus Local Kdrv Com

What Is The Oregon Transit Tax How To File More

State Of Oregon Blue Book Government Finance State Government

Oregon Judicial Department Tax Court Opinions Tax Court Opinions State Of Oregon